I. Overseas expansion and market substitution of Chinese equipment manufacturers

Setting up factories overseas to avoid tariffs

Chinese mining equipment companies have set up production bases in Peru, Zambia and other places to reduce production costs and avoid the 25% tariff imposed by the United States, while improving local service capabilities and accelerating the replacement of the US equipment market share 35%.

Highlighting the cost-effectiveness advantage

The US tariff policy has led to a surge in the cost of its local mining machines (such as the cost of Bitmain Antminer S19 increased by US$1,250 per unit). Chinese equipment has become the preferred supplier in emerging markets such as Southeast Asia and Africa with its technological maturity and price competitiveness.

Regional transfer of supply chain

The United States promotes the “de-Sinicization” of key mineral supply chains and requires battery minerals to be processed in North America or free trade partner countries, forcing Chinese equipment manufacturers to strengthen cooperation with resource-rich countries such as African copper mines and Latin American lithium mines to form a regional supply network

.

.

2. Adjustment of global supply chain and cost transmission

Capacity transfer trend of mining enterprises

High tariffs force US mining enterprises to transfer production capacity to regions with lower electricity prices or loose policies (such as Central Asia and the Middle East), driving the growth of local mining equipment demand. Chinese equipment manufacturers have seized the opportunity by providing customized solutions.

Survival pressure of small and medium-sized mining enterprises

The 25% tariff has reduced the profit margin of small and medium-sized mining enterprises from 37% to 25%. If the tax rate rises to 60%, their profit margin may fall below the break-even point, accelerating industry integration and concentrating on leading enterprises.

Emergency strategies and stockpiling behavior

In the short term, US mining enterprises have hedged risks by hoarding second-hand equipment and using clean energy policies, but the long-term dependence on Chinese equipment is difficult to change, and transshipment to third-party countries may cause supply delays of 2-6 months.

3. Technological barriers and challenges to the resilience of the industrial chain

Accelerated localization of key components

Chinese packaging and testing companies have “de-Americanized” the equipment and material supply chain, with a domestic substitution rate of nearly 100% for key production equipment, reducing dependence on American technologies such as EDA software and enhancing risk resistance in overseas markets.

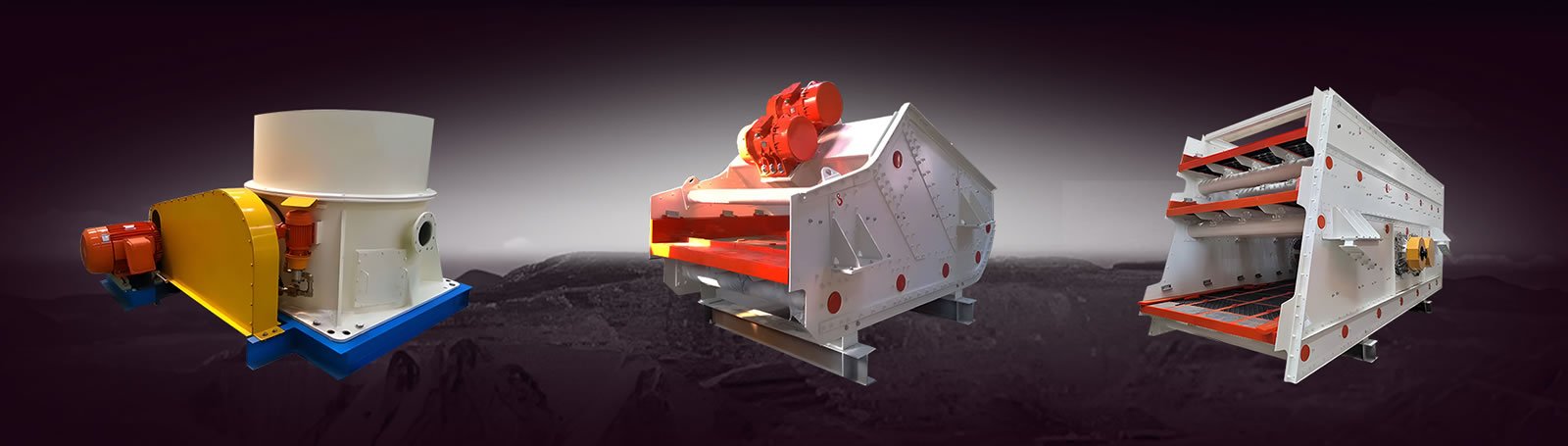

Technological competition is heating up

The United States has imposed tariffs on 30 key minerals, pushing Europe to join the squeeze on China’s industrial chain, and the direct competition between China and the United States in the field of high-end mining equipment (such as high-efficiency and energy-saving ore dressing machines and intelligent mining machines) has intensified.

4. Regional market differentiation and new growth points

Opportunities in Southeast Asia and Africa

The deepening of RCEP regional cooperation promotes the “China + 1” strategy in Southeast Asia. China’s imports of intermediate equipment are planned to increase from 35% to 50%, providing a new channel for equipment exports; the demand for copper mine development in Africa is growing, and Chinese equipment manufacturers dominate the market with their cost advantages.

Latin American market fills the gap

Latin American countries such as Chile have reduced orders due to the impact of US tariffs. Chinese companies fill the market gap through localized cooperation (such as technology licensing and joint ventures) while circumventing tariff restrictions.

Summary: The US tariffs have accelerated the process of China’s overseas substitution of mining equipment. China has consolidated its market share through regional factory establishment, cost advantages and technological upgrades, but it needs to deal with regional supply chain reconstruction, technological barrier upgrades and the risk of key mineral supply chain disruptions. Africa, Latin America and Southeast Asia have become new growth poles, while US domestic mining companies are facing the dual pressures of cost surges and increased industry concentration.